Market Update 24 February 2022

By Dan Boardman-Weston, Chief Investment Officer

After weeks of uncertainty and escalation, Russia has invaded Ukraine. Whilst Western leaders have been warning of such an eventuality for several weeks, it still seemed like an improbable notion for many, given the audacity required, the complexities to be managed and the ramifications to be felt by Russia. Putin is an unpredictable character though, and the next act in this tragedy is as unpredictable as the previous ones. Other commentators will do a far better job than me at trying to analyse and predict what may happen next, and so I shall only dedicate a few lines to it. I see a few options available to Russia over the coming days and weeks:

- Option 1: Russia recognises that they’ve mis-stepped and having destroyed key parts of the Ukrainian military infrastructure decide to retreat.

- Option 2: Russia is intent on neutralising any ‘threat’ from Ukraine, proceeds to take over the country and installs a puppet government, in effect making Ukraine a vassal state and creating a larger buffer between Nato and Russia.

- Option 3: Russia is intent on occupying Ukraine and making it part of Russia. Russia takes over the whole country and occupies it on a permanent basis, trying to incorporate it into Russia.

- Option 4: Russia invades parts of Ukraine and seeks to occupy these smaller areas that are more receptive to being part of Russia.

In my opinion, I only see option 2 and option 4 as being likely outcomes. I don’t believe that Russia is likely to back down from this invasion and I don’t believe they have the capability or appetite for a full long-term occupation of Ukraine. Putin wants some territory and/or regime change in Ukraine, and I suspect he will get the former and possibly the latter depending on how aggressive he is.

Markets have reacted negatively to the news today, with European markets dropping by 5%, UK markets falling nearly 4% and the Russian stock market falling a record breaking 45% in a single day. The fall in markets that we are seeing today, compound the large falls that we have already seen during 2022 and make this one of the worst starts to the year for markets in quite some time.

Other factors are affecting markets such as the lingering economic effects of Covid, the high levels of inflation and the prospect of interest rates rising sharply this year. The convergence of all these factors in a such short space of time has led to significant amounts of volatility with little clarity on when it might abate. Whilst the short term appears uncertain and worrying, it is important to focus on the long term. That’s easier said than done but I’d recommend that you read the commentary that I produced a few days ago (https://brigroup.co.uk/market-update-february-2022/). As Mark Twain is alleged to have said ‘History doesn’t repeat itself but it often rhymes’. I take comfort in the fact that out of all the crises that have sent markets lower, none have been fatal, and markets have always regained their previous highs and gone on to higher levels.

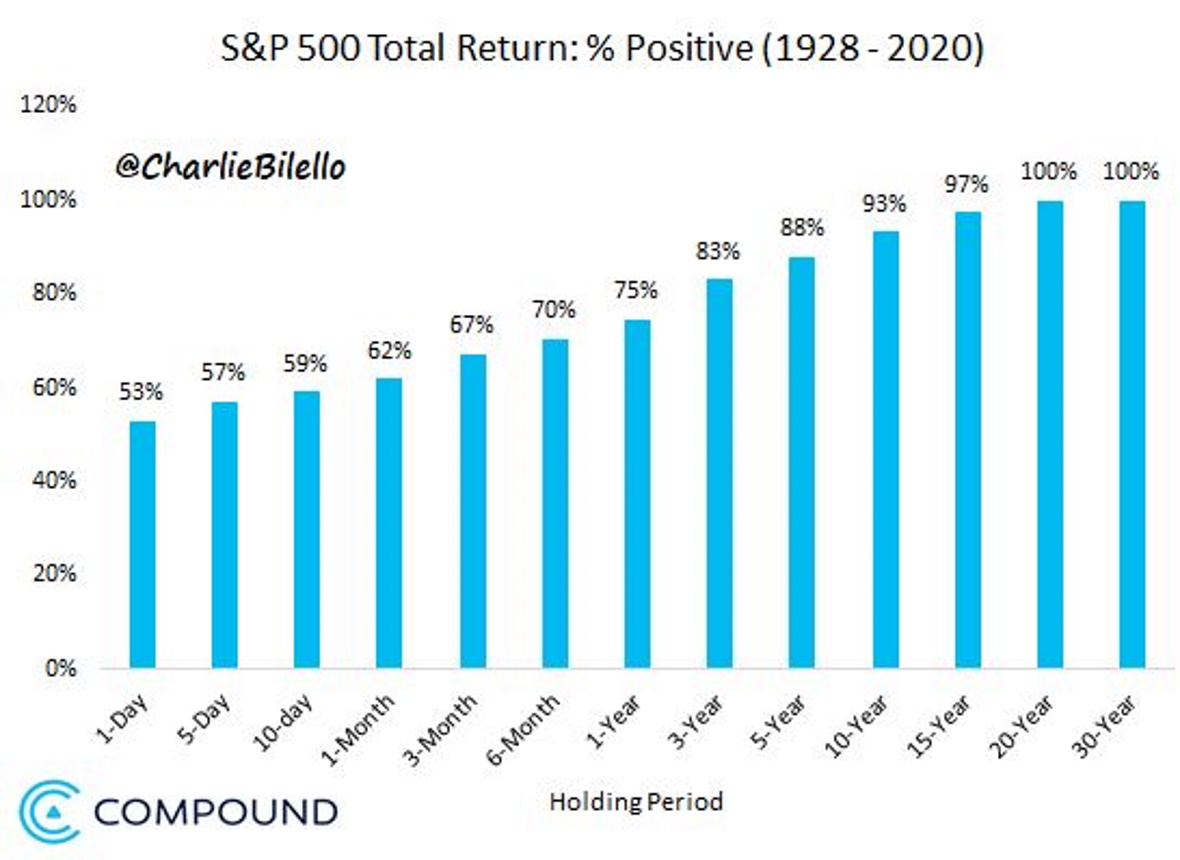

I go back to a point that I try and make as frequently as possible to clients and investors; Time in the market is far more important than timing the market.

The chart below looks at historical data for the US stock market. What it shows is that if you invest for 1 day, 53% of the time markets move higher, for 1 year that rises to 75%, for 10 years that rises to 93% and for 20 years that rises to 100%. In essence what that means is that over any 20-year period as an investor (US in this case, though the data won’t be wildly different for UK markets) you have made money.

An investors time horizon is so important, and I find it useful to reflect upon this when the short term looks so uncertain. The graph below is a nice illustration of the history of stock markets.

Whilst we’re very much focussed on the long-term opportunities of investing, bouts of volatility, like we’re seeing, lead to investment opportunities for the patient and rational investor. We have different (metaphorical) levers that we can pull on portfolios in order to capitalise on the opportunities that are presenting themselves. We fully expect that we will pull some of these levers over the coming hours, days and weeks and that this will lead to positive outcomes for clients over the medium term.

The events over the last few hours have been unsettling and the falls in markets over the last few weeks have been frustrating. However, we’re doggedly focussed on the long-term opportunities that our investments have and are quite happy to take advantage of short-term volatility in pursuit of longer-term returns. To quote some the first and last two lines from the poem ‘If’ by Rudyard Kipling:

‘If you can keep your head when all about you

Are losing theirs and blaming it on you,’

‘Yours is the Earth and everything that’s in it,

And—which is more—you’ll be a Man, my son!’

We will continue to steward your capital and are available for any questions that you may have.