Market Update 22 February 2022

By Dan Boardman-Weston, Chief Investment Officer

The start of 2022 has been especially poor for investors due to interest rate/inflation expectations, a potential Russian invasion of Ukraine and the lingering impact of the Covid pandemic. This confluence of factors is causing a significant amount of volatility within equity and fixed interest markets which has led to one of the worst starts to a year for markets in a long time. I don’t propose to explain these issues in this note but want to revisit some notes that I wrote several years ago. The essence of these notes is that market volatility is to be expected and that whilst it can be highly uncomfortable for investors, the market is highly resilient in the long term. Time in the market – not timing the market, is the most important factor to consider when investing, and being able to tolerate the volatility leads to good long-term returns. The table below neatly illustrates this point.

Staying Invested the Whole Time vs Timing the Market:

The current issues that are causing this volatility are likely to persist over the coming weeks and months but markets will overcome these problems, as they have overcome countless issues over the prior decades and centuries.

Market Update – Q1 2020

The last week or so has been bruising for markets. We’ve had several days that have seen very large falls in markets, predominantly as markets start to come to grips with the likely economic impact that Covid19 will have.

The UK market has fallen 33%, the American market just under 30% and the European markets about 35%. This is some of the severest fall that many have seen in markets and it has taken place in the space of five weeks. It’s taken 11 years to build one of the greatest bull markets of all times and just 11 days to break it.

It is very easy to get caught up in the pure emotion and fear that markets are exhibiting, but now is the time for calm and rational thinking. I always like to look back on previous crashes and use the experience of those events that we have endured to put things into context. Mark Twain allegedly wrote that ‘History doesn’t repeat itself, but it does rhyme’. I think it is quite an apt statement that can be applied to stock markets. Whilst we’ve never had to deal with a crisis quite like this, we have had to deal with numerous financial crises over the years. Notable ones from the past forty years include:

• Bursting of the Japanese asset price bubble of the 1980s

• Black Monday in 1987 (markets fell over 22% in one day)

• Black Wednesday in 1992 when the government had to withdraw from the exchange rate mechanism (ERM)

• 1997 Asian Financial Crisis

• 1998 Russian Crisis and the collapse of Long-Term Capital Management

• The bursting of the dot com bubble between 2000-2003

• The terrorist attacks on September 11th, 2001

• The Great Financial Crisis between 2007-2009

• The eurozone crisis between 2011-2012

• The Oil crisis of 2015 when Oil fell from $120 to $28 a barrel

• The Scottish referendum

• The Brexit referendum

• The escalating trade war in 2018

All of these events have led to a 20% or greater fall in markets. Yet markets have recovered each time. Markets will recover this time. We have never experienced a crisis quite like this and it will continue to cause uncertainty and pressure for some time to come.

What we know about the crisis is that social distancing in Asian countries has worked well at slowing the spread of the virus. This does come with an economic impact but this impact at the moment appears relatively temporary in these countries. Economic data appears to be stabilising and improving in China and anecdotal evidence seems to support this view as well. The owner of B&Q mentioned yesterday that 95% of the factories that it purchases from in China are back up and running.

As we expected, we have seen a whole host of central banks across the globe cut interest rates to 0%, or even lower and resume their quantitative easing programmes. What everyone needs to see though is a coordinated fiscal response from governments across the globe. They need to provide temporary finance to the many businesses and consumers that are likely to face cash flow issues.

For those in financial circles, many will remember the speech in July 2012 by the head of the European Central Bank. The Eurozone crisis was raging and the very future of the eurozone was in jeopardy. His speech changed the course of history and gave the market confidence. The key line of that speech was ‘Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough’. We need another ‘Whatever it takes’ moment from governments across the globe.

The long-term intrinsic valuations of most businesses have not been impacted by this crisis. After this crisis has abated, we are still going to go about our normal day to day lives in the and still spend money in the same ways that we have been used to. Share prices moving so violently on a minute by minute basis create a great sense of despondency and an illusion of rapidly changing prospects for businesses. Yes, there are short term issues but companies over the long term are valued based upon their long term cashflows, not short-term sentiment. In the words of one of the most famous investors of the 20th Century, ‘In the short run, the market is a voting machine but in the long run, the market is a weighing machine’. His protégé, Warren Buffett, took a slightly more proactive approach to market panic, ‘We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful’.

We have been conducting some trades in portfolios, but we have not sold shares. What we have sold is some of our lower risk bond investments. They have held up remarkably well thus far, either being very slightly up or very slightly down. The investments that we manage on your behalf are good quality companies where the long-term fundamentals look attractive and haven’t deteriorated, despite the events of the last few weeks. We’re not in the business of selling things for knock down prices in a fire sale. We are happy to weather the storm. However, we have not bought shares yet either. Why? Well, we are still of the opinion that we have not reached peak fear. Now, I’ve mentioned the inherent difficulty in trying to time the market and I still stand by my thoughts on that. I’m not trying to call the bottom or aim to invest your capital at the very low of the market, no one will manage it, if they do it will be pure luck. I wrote about in the last few updates the concept of peak fear and how I didn’t believe we’d reached it just yet. I still don’t think we’ve reached it, but the tell-tale signs are starting to appear, panic buying, a rapid increase in cases, two of the worst days in stock market history. We’re getting to peak fear, but I still think that it may be a bit further away. Once we have a bit more clarity over the situation, we will be carefully considering investment opportunities, where we believe valuations are materially below their long-term intrinsic value.

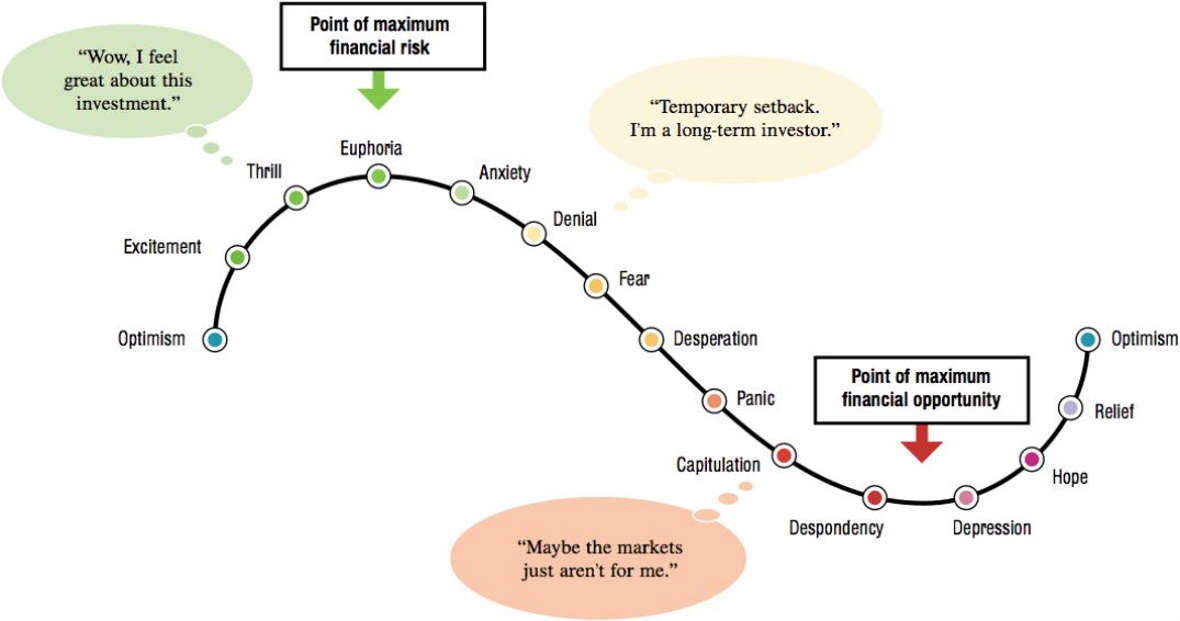

As many know, markets, businesses and economies go through cycles and the peaks and troughs are an integral part of cycles. Investors emotions tend to correspond with market cycles and emotions change as we move through different parts of the cycle.

It’s important to recognise the role emotion can play in investing, but recognising it is the first step in taking advantage of it. Fear, desperation, panic, capitulation, despondency and depression are all emotions that we are going to feel about the markets over the coming period. However, calm and rational thinking will prevail, and it gives the patient and logical investor opportunities to generate attractive long-term returns.

All of this is occurring as we enter the end of the financial year when many are thinking of ISA and pension contributions. It can be difficult to think about these matters at times like these, but investors should not let market emotions change their long-term investment strategies. As Warren Buffett also said, ‘look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it’.

Market Update – Q4 2019

“We didn’t start the fire”

I’ve always been a fan of music and how it can evoke such powerful emotions and memories. One of my first musical memories was hearing Mark Knopfler of the Dire Straits singing ‘Sailing to Philadelphia’ on Radio 2 as I was carted off to school one morning by my mother. I never knew what the song was at the tender age of five, but that memory and emotion came flooding back when I heard the song again many years later. Never did I imagine that one of my desert island discs would be about an 18th century astronomer and surveyor.

Anyway, I’ve been rekindling my relationship with the music of Billy Joel recently. In terms of his best work, it’s a hands down win for ‘Piano Man’ and ‘Vienna’. However, the song that has most resonance with an article about stock markets has got to be ‘We didn’t start the fire’. For those not familiar with the song, it is a chronicle of over one hundred events, spanning half a decade that emphasises the sheer volume of significant events that occur in the world on a regular basis. This got me thinking about stock markets and the numerous events that have occurred over the last decade. Many of these events were seen as hugely significant and most led to bouts of volatility in the market as people feared the potential ramifications of them.

Testing my memory of the last decade is tricky after an over-indulgent Christmas but the non-exhaustive list of events include; the Eurozone crisis parts un, deux and trois, fears over the PIIGS (Portugal, Ireland, Italy, Greece and Spain) status in Europe, the numerous fears over the US debt ceiling, Scottish independence referendum, four UK general elections, the Brexit referendum, the slowing of Chinese growth, the collapse of the Chinese stock market, the taper tantrum, the end of Quantitative Easing, first interest rates rises for a decade, the oil price crashing 75%, the legacy issues of the financial crisis, the Ukrainian crisis and that American election.

Yet here we are. The world is still turning, and the markets are celebrating the best and longest bull run on records. When you’re living through these events, they can be scary, and they can seem like the most consequential event in memory. But they’re not. Now of course they need to analysed rationally and you need to ensure that you’re well diversified and positioned appropriately but in most instances they sort themselves out and present good buying opportunities for the patient investor.

I occasionally wheel out a quote by Benjamin Graham, ‘the father of value investing’, who said that ‘In the short run, the market is a voting machine but in the long run it is a weighing machine’. I usually use this as a short term reminder for one to be stoic in the face of market uncertainty but now use to prove that it has been correct over the last ten years, correct over the last 50 years and correct over the last 100 years. Patience is one of the best virtues an investor can have and will continue to be a powerful tool in this next decade.

I’ve got no idea what the coming year will hold, let alone the next decade. One thing I am sure of though is that there will continue to be highly significant and potentially scary moments for the stock market. These will provide opportunities for the patient investor and we believe that equities will continue to provide adequate returns above the level of inflation. This year may see volatility as our relationship with the European Union continues to evolve and the Americans undertake another election but we continue to be positive on the long term prospects for the world. I hope to be writing an article this time next year about ‘Yazz’ and ‘The only way is up’ but if its about Billy Ocean and ‘When the going gets tough’ then so be it.