What is cash flow modelling and how can it add value to your circumstances?

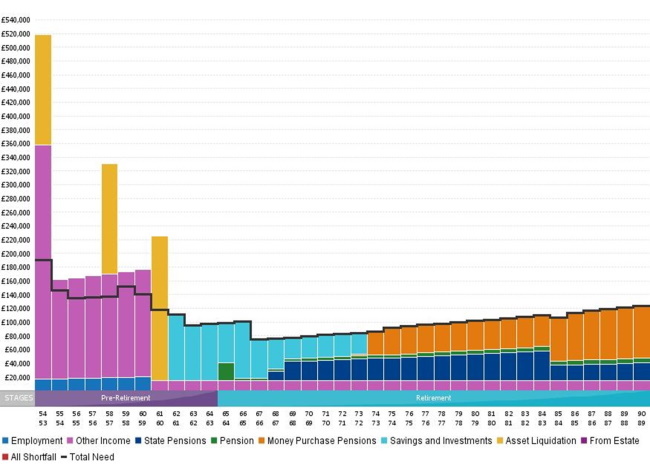

A cash flow model is a detailed picture of a client’s financial situation which includes their assets, liabilities, income and expenditure, not only at the current time but also in the future. This information is inputted into a sophisticated software model which is then used to project forward each year by using assumed rates of growth for each individual element.

This offers the client, and their financial planner, the opportunity to investigate the future of their financial position and can help them to make well-informed decisions in the here and now. The software also allows advisors to create ‘What if?’ scenarios based on the potential of future events such as unexpected death or illness, changing a retirement age or – which is now more pertinent than ever – the potential impact of market volatility. Cash flow modelling is often most powerful when run through with a client in real time and can be used to frame conversations around some common and important questions, such as:

• At what age can you retire and live the lifestyle you desire?

• What actions need to be taken to achieve your financial objectives?

• Will you ever run out of money?

• Can you afford to gift assets away without it affecting your long-term planning?

• If your spouse or partner passes away, will you have enough money to live on?

• Can you afford long-term care if it is required in the future?

• How much Inheritance Tax will your beneficiaries have to pay?

• How much do you need to sell your business for?

• What will be the effects of varying inflation and investment returns?

A cash flow model can help with answering all the above questions and many others. Of course, there are no guarantees, and any cash flow model is built on a series of assumptions because we sadly do not have a crystal ball. However, the use of this important process is now a significant element of financial planning to help clients achieve their long-term goals and objectives. To the left is an example of one of the outputs showing how cash flow can be illustrated over multiple years; however, the software and process can provide many other scenarios.

* the black line indicates expenditure, either pre or post retirement

The general impression held by the public is that financial planning is all about investments, pensions and ISAs (because that is all the popular press seems to focus on). But truly effective financial planning is about the bigger picture – helping people to make life-changing decisions for their own and their families’ future security and happiness.