Have you started saving for school fees?

Many parents want to give their children the best possible opportunities in life, and that starts with a great education. This is the reason why many parents opt to send their children to private schools. However, the rising costs from childcare right through to university fees, means that for some, additional finances and funds need to be allocated and set aside, solely for this purpose.

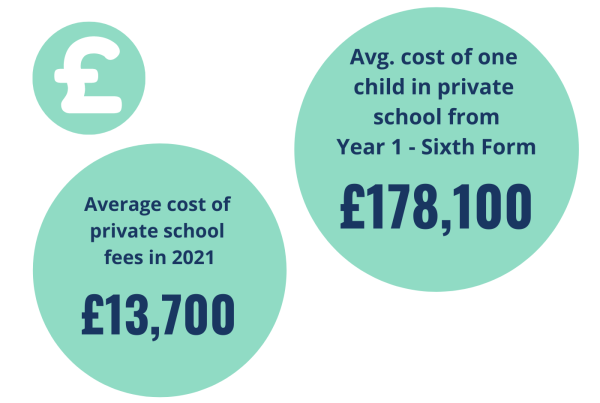

According to The Guardian, in 2021, the average private school fees were £13,700 a year. That means to send one child to private school from Year 1 through to Sixth Form, would cost around £178,100.

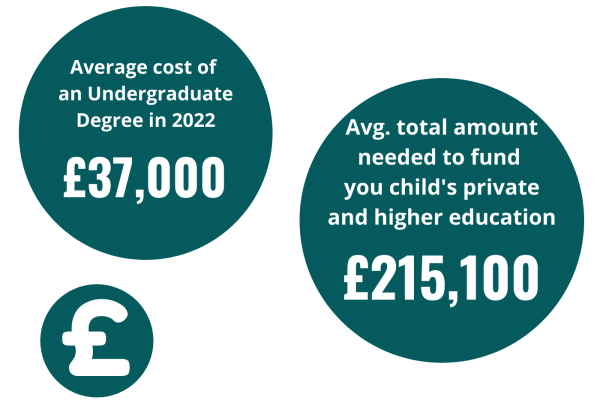

Currently in 2022, the average Undergraduate Degree costs around £37,000. Therefore, you would need a substantial £215,100 to fund your child’s private and higher education.

For those of us who may not have that level of additional funds on reserve however, there is hope. Whether you already have children, or are planning on having them in the future, putting measures in place now to assist with funding their education later on in life, is a wise idea.

There are several financial planning avenues to explore that would assist creating additional income sources and maximise your saving abilities to put you in the best possible position to achieve your financial goals. To ascertain the appropriate means for you, will depend ultimately on your timeframe.

If you have somewhere in the region of 5-10 years+, then investing could be your ideal solution. Any short-term market fluctuations should have time to correct themselves. Diversification is also important when creating an investment portfolio. That being said, as with any investments, your capital is always at risk.

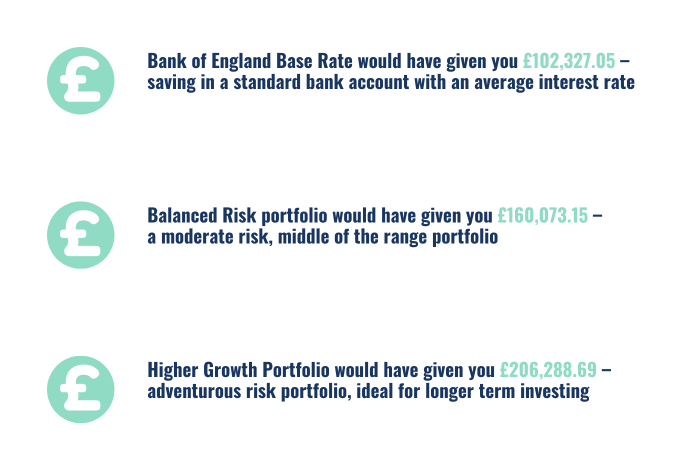

Below are some examples of potential returns if you had £25,000 to initially start with and invested £300 per month from the time your child was born in 2004 until they reached the age of 18 in 2022, depending on different saving scenarios:

If you are looking at a more short-term financial solution, then cash savings may be your best option. Remember to review the market for the best interest rates, some accounts may also have limits on quantity and frequency of withdrawals.

If you wish to speak to an Advisor about your potential options for a long-term savings plan, please do not hesitate to contact BRI on 01676 523 550 or make an enquiry here.