Buy to Let Property

Why are buy-to-let investors exiting the market?

Buy-to-lets have attracted a great deal of negative press in recent years, with investors taking blame for rising house prices and the difficulties faced by first time buyers and “generation rent”. The government has in recent years penalised buy-to-let investors with tax and regulatory changes, which has resulted in many investors leaving the market. Many commentators feel that in the current political climate, buy-to-let investors will continue to be seen as an easy target to blame for rising house prices, and it is likely that the government will continue to target investors with punitive tax measures. We have highlighted below some of these recent measures and the impact they can have.

Income tax and mortgage relief

Since April 2017, the way landlords must declare their rental income has changed. Tax relief on mortgage interest has been phased out. Since April 2020, landlords can no longer deduct mortgage expenses from rental income and will instead receive a tax-credit of 20% on mortgage interest payments. As a result, many landlords have seen their tax bills rise significantly, particularly if they are higher rate or additional rate tax payers.

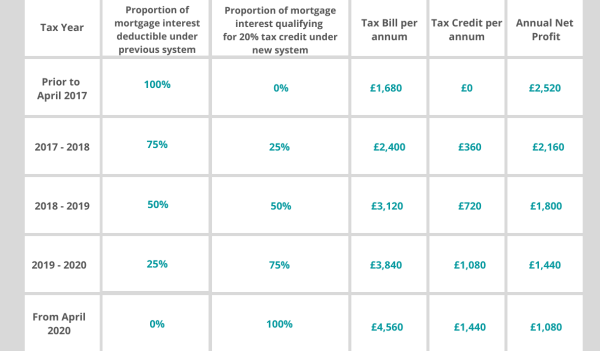

The table below details how the changes affect a higher rate tax-paying landlord receiving £950 rent a month (£11,400 per annum) and paying £600 per month (£7,200 per annum) towards their mortgage.

The above table shows that as a result of the changes, the landlord’s net profits would reduce by 57%.

Stamp Duty

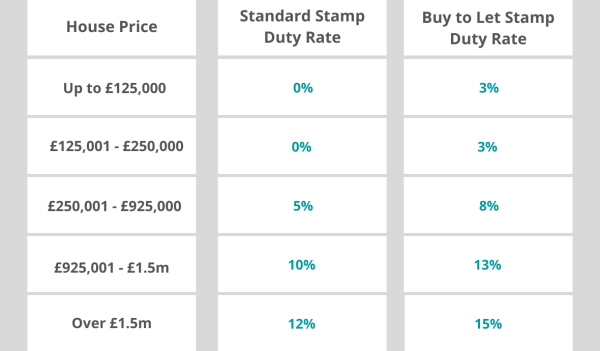

Since April 2016, landlords pay an extra 3% of Stamp Duty on each band when purchasing a buy-to-let property.

The surcharge can potentially add thousands of pounds to the Stamp Duty bill. It was announced in the Spring Budget 2020 that there would be some Stamp Duty relief, however this was only in effect until 30 June 2021.

The table below summarises the rates from 1 July 2021 onwards, that will remain in place until 30 September 2021.

A £300,000 property would generate a Stamp Duty tax of £5,000 under the standard rate. Due to the increased rate, a buy-to-let investor would be charged an additional £9,000 and face a total Stamp Duty tax of £14,000 for this property.

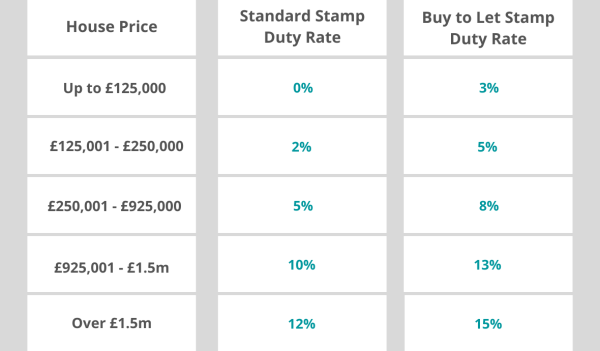

From 1 October 2021, the previous reduced rates shown above will revert back to the former SDLT rates that were in place prior to 8 July 2020. See below:

Capital Gains Tax (CGT)

Buy-to-let investors face an increased CGT rate of 18% for basic rate tax payers and 28% for higher and additional rate tax payers, in comparison to rates of 10% and 20% for other investments such as stocks and shares.

Alternative Investments

Whilst many investors continue to find value in buy-to-let investments, there is no doubt that these investments have become less profitable due to changes in tax and regulation; and in the current political climate, it is likely that buy-to-let investments will continue to be taxed harshly. As a result, more investors are instead choosing to invest in a number of tax-efficient investments such as ISAs, pensions, VCTs and other schemes which benefit from tax relief.

Investments within an ISA, for example, are free from CGT and income tax.

If you would like further details on potential alternative investments, please contact one of our Wealth Managers via invest@brigroup.co.uk who would be happy to discuss this with you.