Equity Release

We are all familiar with the Equity Release adverts throughout the media and it is now a £4bn annual business. Put simply, equity release allows homeowners aged over 55 the chance to release some of the equity (cash) tied up in the value of their home and the ability to stay living in that home until moving into residential care or passing away.

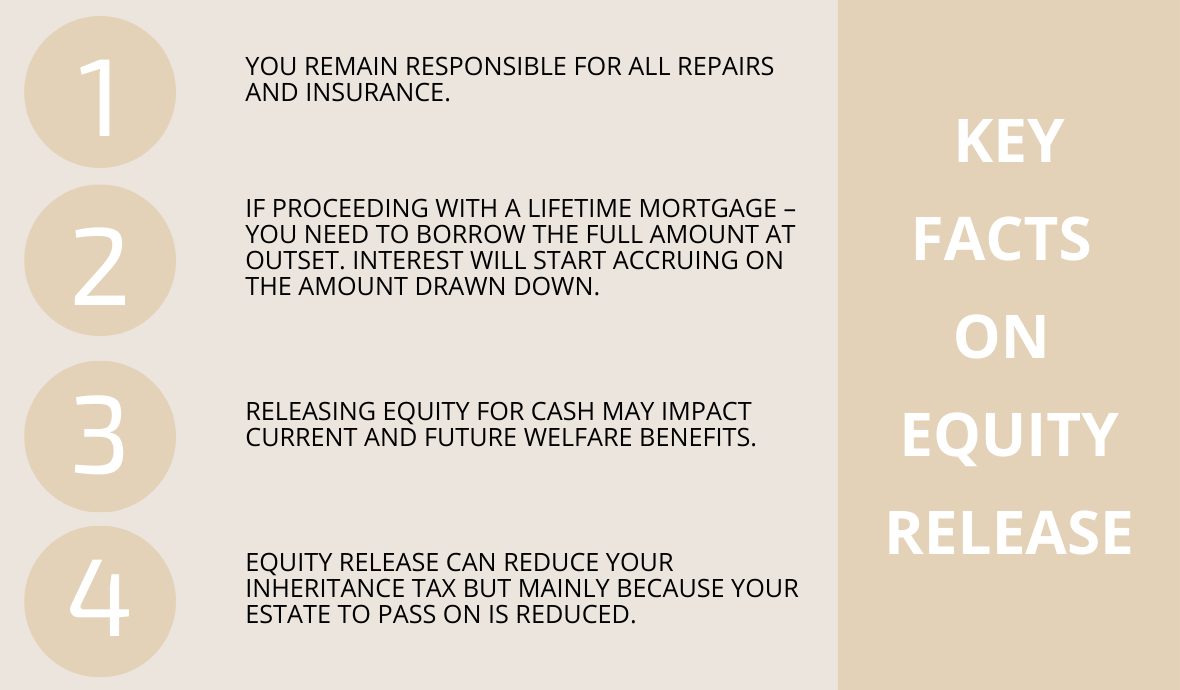

Like all significant financial transactions, knowing the detail and obtaining the right independent advice is critical. The size of the market shows that it undoubtedly has a place given certain circumstances, but it is certainly not appropriate for many.

The most common form is a Lifetime Mortgage. The loan is secured against the property until either death or the move to a care home. Interest can be paid monthly on this loan with certain schemes, or it can be “rolled up” at an annual rate which leads to the compound interest impact which can

be very significant over the years. This is available for those aged over 55. The cost of this Mortgage is significantly higher than most standard mortgages offered on the high street.

The second option is a Home Reversion plan. Here the provider pays a tax-free lump sum for a portion (%) of your property. This will always be below market value but does again mean that you can live rent free until death or sale. The portion owned by the provider remains constant e.g., 40% throughout the contract meaning that on sale the provider benefits from the increase in the property’s value.

Conclusion

Always take independent advice and involve other family members so that they gain an understanding of what you are seeking to achieve and do ensure you consider all possible alternatives, for example, downsizing your property may provide a more desired result.