Turning the Corner

The past two years have been extremely challenging for markets, as higher inflation and higher interest rates led to a significant re-pricing of assets. The genesis of this seemingly perma-crisis lay with the significant supply disruptions caused by the Covid pandemic and the war in Ukraine, coupled with extraordinarily large fiscal and monetary policy reactions to alleviate the economic impact of the pandemic. As a result of these factors, inflation reached the highest level in over forty years, and central banks responded with the most aggressive hiking of interest rates in recent history. The uncertain direction of interest rates and inflation has led to the worst performance for many assets in decades, and in some instances, centuries.

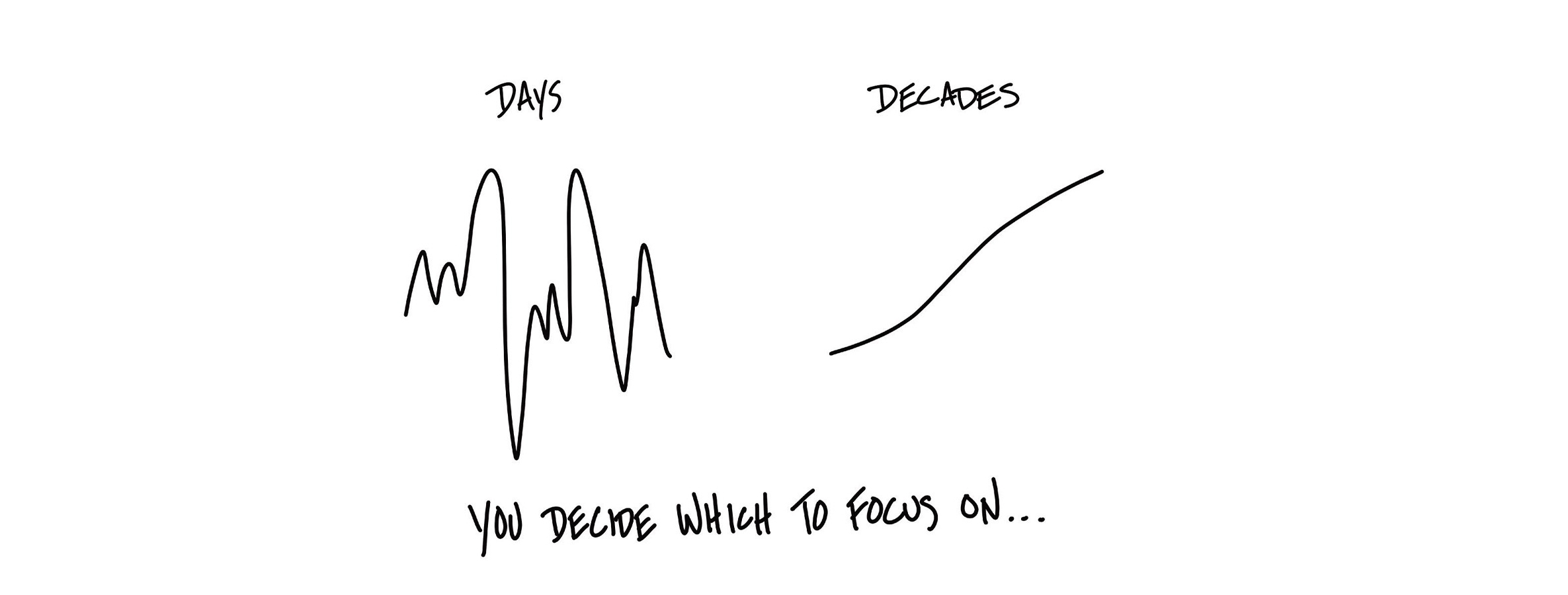

Poor periods of performance in the stock market are inevitable, but it still makes it a hard pill to swallow. We live in the present, and it can be very hard to focus on the rational argument about long-term returns and investment requiring patience when things seem gloomy. We try to approach such challenging short-term conditions by reassessing our investment theses, making changes if required, and focusing on the long-term.

It is pleasing that the final few months of 2023 saw greater clarity for markets and delivered better performance than has been the case for some time. The cause of the sudden change in direction for asset prices was a string of positive inflation data that allowed central banks to stop raising interest rates and hint about rate cuts during 2024. Equity and bond markets responded very well to this, with both delivering solid returns during November and December. Greater returns were seen in some of the areas that have suffered more during 2023, predominantly property, infrastructure, and investment trusts. Many of these assets delivered double-digit returns during the final few months of 2023, with the strongest returns in commercial property investments. In the strategies that hold property this is typically achieved via REITs (Real Estate Investment Trusts) which are predominantly focused on warehouses and industrial properties. This is an area that has very strong structural growth drivers over the coming years, however investors have been disproportionately and irrationally negative during 2023. Our investment theses remain intact with these holdings, and we are still confident in the long-term outlook, though remain vigilant to other areas to deploy the capital that may present themselves.

As we enter 2024, some of the risks that have dominated 2022 and 2023 have started to subside, but others, such as the conflict in the Middle East and slowing economic growth, remain. It is likely markets may pause for breath after the strong performance witnessed in November and December or could experience volatility if rate cuts fail to materialise as expected. However, markets continue to look attractive for the long-term investor.

Navigating through challenging market conditions can be tough, but we remain appropriately diversified and suitably positioned to generate good returns for investors over the medium to long term. It is normal for markets to move up and down in the short term, but rare for markets to move down in the longer term. As the famous investor Benjamin Graham said, ‘In the short run, the stock market is a voting machine. Yet, in the long run, it is a weighing machine’. Patience and resolve are required for investing successfully and helping to achieve long-term financial goals.

2024 is likely to have its twists and turns and its ups and downs. We will continue to try and navigate these and are hopeful that there may not be as many as in the last few years. The long-term looks as bright as ever.

We wish you and your family a happy, healthy, and prosperous 2024.