With the final bank holiday of the year behind us and as the UK bids farewell to summer’s promise of sun-drenched days and azure skies, both the weather and global equity markets seemed to conspire in a decidedly lacklustre August narrative.

After a strong first half of the year, the market’s mood has shifted in August with both US and International equities taking what still looks like a pause for breath. A fierce artificial intelligence-led rally in the U.S. stock market ran out of steam in August, with the S&P 500 index snapping a five-month winning streak and the US technology heavy Nasdaq recording its biggest monthly decline this year.

Looking back through time, it’s not uncommon for markets to experience sideways / softening performance in August as traders and investors go on holiday before the summer ends leading to much thinner trading volumes and quieter corporate activity, however this can lead to more volatile swings in prices.

Bonds fared better than Equities in August. The UK Corporate Bond Sector and the UK Gilts traded sideways over the month. Developed Equity markets drifted downwards with the UK Market recording a negative return of -2% with the European and Japanese market fairing similar. The US market was slightly better, albeit still recording a negative return of -1.3% in the month.

Fears around a slowing Chinese economy weighed on global equity markets in the middle of August. The world’s second-largest economy reported much weaker-than-expected retail sales growth for July, while industrial production also rose less than expected. China is facing a severe property-sector decline which is slowing economic growth and seemingly slowing spending decisions from the Chinese consumer which may have negative consequences on the rest of the world.

Elsewhere, little new information came from the Federal Reserve’s Jackson Hole meetings. A US interest rate pause at the September meeting looks relatively likely, on an assessment that rates are already well into restrictive territory. Across the Pond, the BRI investment committee suspect to see one more quarter percent rise in interest rates from the Bank of England in September before they hold interest rates. The UK economy has been resilient up until now and the labour market remains tight. UK Core inflation remains stubbornly high and still well above the 2% target set by the Bank of England meaning there may not be justification for rates to come down as quickly as early in 2024 as people may assume. The ‘higher interest rates for longer’ narrative has loosely contributed to some of the recent weakness we’ve seen in equity markets across the US, UK and European markets.

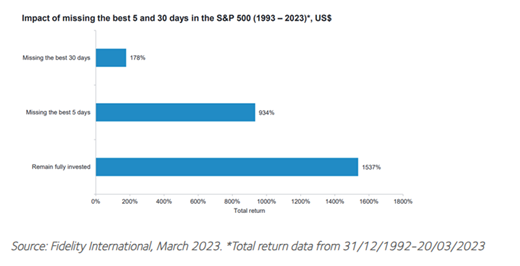

Looking ahead, whilst volatility may persist for the short term as global economies slow, it’s important to stress the benefit of patience with investing and the impact of the old adage “it’s about time in the market, not timing the market”. Returns on cash accounts have risen rapidly over the past 12 months, However, it’s important to stress that the return remains below inflation and is eroding capital in real terms. Once inflation falls closer towards the Bank of England’s target of 2%, then it’s likely interest rates will begin to drift downwards at which point the return on cash accounts will fall. History shows us that over any reasonable timeframe, assets like equities and bonds deliver superior real returns versus cash.

The impact of trying to time the market can have catastrophic impacts on your long-term returns as the graph below shows:

The world has jumped from crisis to crisis over the last 3 years, with equity and bond markets experiencing the impact of this uncertainty. I have every confidence that better days lie ahead for investors taking a longer-term view and it’s in times like this, where the best investment opportunities arise. It’s important to remember that inflation, rising interest rates and recessions are a normal part of an economic cycle. Markets have experienced them in the past and have always bounced back stronger. This time is no different, and one should not lose sight of the long-term attractions of investing.

Tom Hopkins

Portfolio Manager

Market Commentary August 2023

With the final bank holiday of the year behind us and as the UK bids farewell to summer’s promise of sun-drenched days and azure skies, both the weather and global equity markets seemed to conspire in a decidedly lacklustre August narrative.

After a strong first half of the year, the market’s mood has shifted in August with both US and International equities taking what still looks like a pause for breath. A fierce artificial intelligence-led rally in the U.S. stock market ran out of steam in August, with the S&P 500 index snapping a five-month winning streak and the US technology heavy Nasdaq recording its biggest monthly decline this year.

Looking back through time, it’s not uncommon for markets to experience sideways / softening performance in August as traders and investors go on holiday before the summer ends leading to much thinner trading volumes and quieter corporate activity, however this can lead to more volatile swings in prices.

Bonds fared better than Equities in August. The UK Corporate Bond Sector and the UK Gilts traded sideways over the month. Developed Equity markets drifted downwards with the UK Market recording a negative return of -2% with the European and Japanese market fairing similar. The US market was slightly better, albeit still recording a negative return of -1.3% in the month.

Fears around a slowing Chinese economy weighed on global equity markets in the middle of August. The world’s second-largest economy reported much weaker-than-expected retail sales growth for July, while industrial production also rose less than expected. China is facing a severe property-sector decline which is slowing economic growth and seemingly slowing spending decisions from the Chinese consumer which may have negative consequences on the rest of the world.

Elsewhere, little new information came from the Federal Reserve’s Jackson Hole meetings. A US interest rate pause at the September meeting looks relatively likely, on an assessment that rates are already well into restrictive territory. Across the Pond, the BRI investment committee suspect to see one more quarter percent rise in interest rates from the Bank of England in September before they hold interest rates. The UK economy has been resilient up until now and the labour market remains tight. UK Core inflation remains stubbornly high and still well above the 2% target set by the Bank of England meaning there may not be justification for rates to come down as quickly as early in 2024 as people may assume. The ‘higher interest rates for longer’ narrative has loosely contributed to some of the recent weakness we’ve seen in equity markets across the US, UK and European markets.

Looking ahead, whilst volatility may persist for the short term as global economies slow, it’s important to stress the benefit of patience with investing and the impact of the old adage “it’s about time in the market, not timing the market”. Returns on cash accounts have risen rapidly over the past 12 months, However, it’s important to stress that the return remains below inflation and is eroding capital in real terms. Once inflation falls closer towards the Bank of England’s target of 2%, then it’s likely interest rates will begin to drift downwards at which point the return on cash accounts will fall. History shows us that over any reasonable timeframe, assets like equities and bonds deliver superior real returns versus cash.

The impact of trying to time the market can have catastrophic impacts on your long-term returns as the graph below shows:

The world has jumped from crisis to crisis over the last 3 years, with equity and bond markets experiencing the impact of this uncertainty. I have every confidence that better days lie ahead for investors taking a longer-term view and it’s in times like this, where the best investment opportunities arise. It’s important to remember that inflation, rising interest rates and recessions are a normal part of an economic cycle. Markets have experienced them in the past and have always bounced back stronger. This time is no different, and one should not lose sight of the long-term attractions of investing.

Tom Hopkins

Portfolio Manager