How to teach children about money and finances

It’s no surprise that good habits can be learned from an early age, so teaching children about money matters from a young age can have a beneficial impact once they reach young adulthood and beyond. As cited in The Guardian, a University of Cambridge study found that children as young a seven can grasp the concept of the value of money and lessons can be learnt which will promote positive financial behaviour.

One of the easiest ways to begin teaching children about money, is to encourage them to start saving. In place of the traditional piggy bank method, research suggests that a clear jar is a better option as young children are particularly good visual learners.

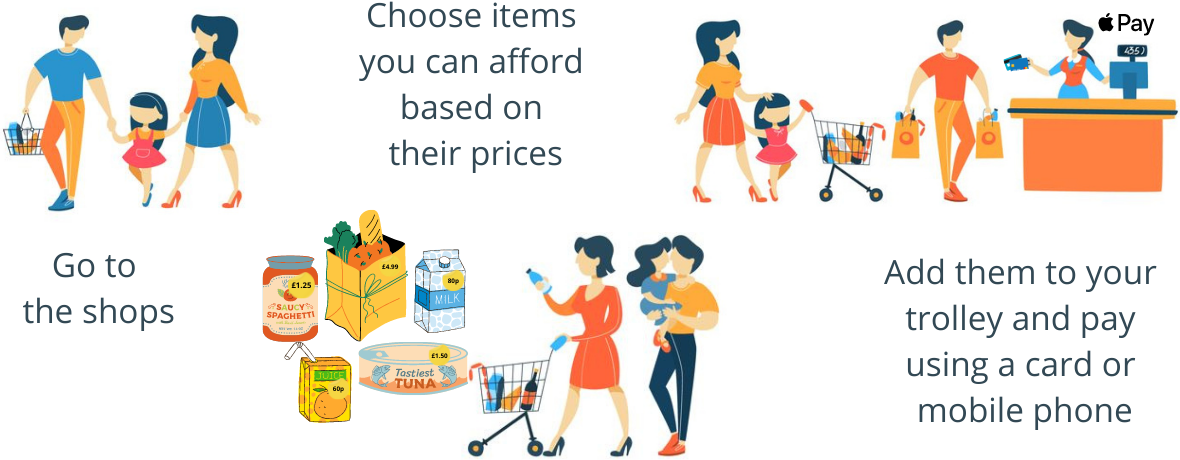

Other ways to introduce the subject of money, is to relate it to everyday moments or things within the house. Whilst on a grocery shop, be very vocal about the items you are adding to your trolley, so children can build up an understanding about costs.

As we know, today’s children are a lot more tech-savvy and in this modern age, where physical cash is fast becoming a thing of the past, explain to children the concept of credit/debit cards and the contactless payments process. Have them hold and tap the card to help build up that psychological association with the entire shopping process –

Explain that by using a card or phone to buy things uses up money that is saved in your bank account (a big savings jar that is stored at the bank).

Of course, when it comes to children, learning is always best when it’s fun! There are several ways through games and fun activities to introduce learning about money and saving into your children’s regular routines.

If your child is into gaming, Island Saver is a free game from NatWest aimed at 6–12-year-olds. RoosterMoney is a pocket money tracker app, where parents can virtually pay real or imaginary money into a digital pot to teach them about earning and the value of money, budgeting and saving.

For more ideas, games and platforms to teach children about money, visit https://www.goodhousekeeping.com/uk/consumer-advice/money/a32813671/money-games-for-kids/

One of the best ways you can give your child a financial helping hand is to set up a Junior Individual Savings Account (JISA). These are long-term, tax-free savings accounts for children. The current 2022/23 allowance is £9,000. For more information and how to set one up, visit https://www.gov.uk/junior-individual-savings-accounts.

Another option to consider is funding a pension for your child or grandchild. Many associate pensions with retirement and perhaps an older generation however few people are aware that children too are able to contribute to a pension. The current pension rules enable a non-income earner (i.e. a child) to add £2,880 in to a pension each year. This sum is then given 20% tax-relief by the Government which means that a further £720 is added taking the total amount added to the pension each year is £3,600.

The child will not be able to access their pension until age 57 (under current legislation) which should be borne in mind however this is an excellent way of educating your child about saving for their future and making sure they have enough saved away for their retirement.

If you wish to speak to an Advisor about the best savings options for your child, please do not hesitate to contact us on 01676 523 550 or make an enquiry here.