Pensions: When should I start paying into one and how much?

The aim of this article is to shed some light on those questions.

Pensions – what are they and how do they work

What does saving in a pension plan mean? Essentially, you put money into a ‘pot’ each month now, to provide a regular income once you are retired later in life. These monthly payments or contributions are tax-free and are then invested to ideally increase over time. Therefore, pensions are the most effective means of savings for retirement. There are three types of pensions, state pensions, personal pensions and workplace pensions.

More detailed information on each type of pension can be found here.

When is the best time to start saving in a pension plan?

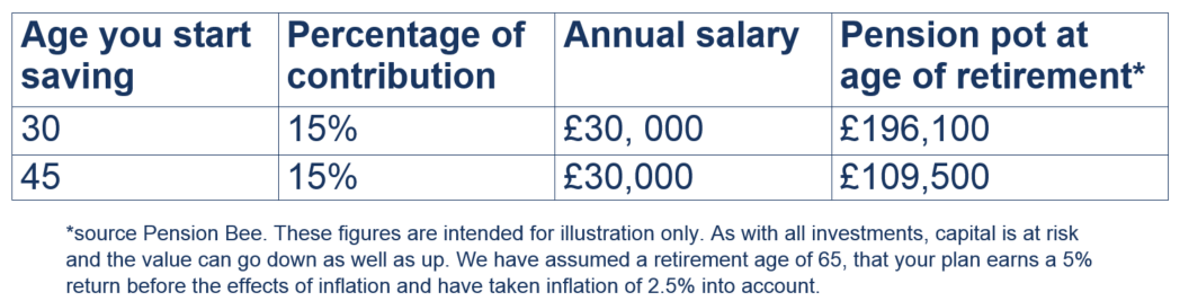

The simple answer to this is as early as is possible, even if it is just a small amount to begin with. For example:

How much should I save and contribute towards my pension?

As a basic guide and starting point, you could take the age you start saving, halve that and begin saving that percentage. For example, if you start at 30, you could contribute 15% of your salary for the rest of your working life. It is worth noting, that depending on whether it’s a personal or workplace pension, there are other factors to consider such as your employer’s contribution, any pay rises or salary increases over the years, and the age you plan to retire.

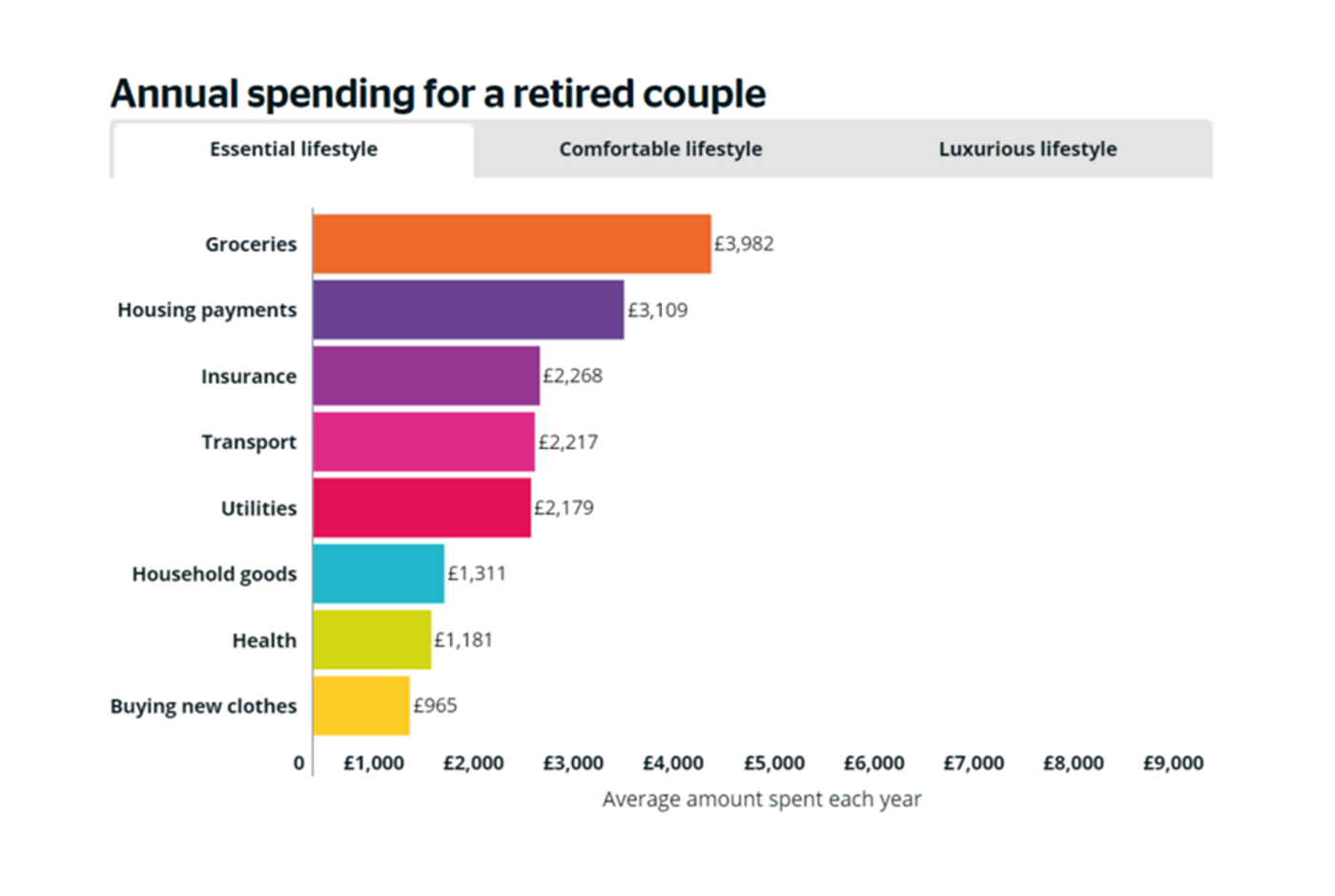

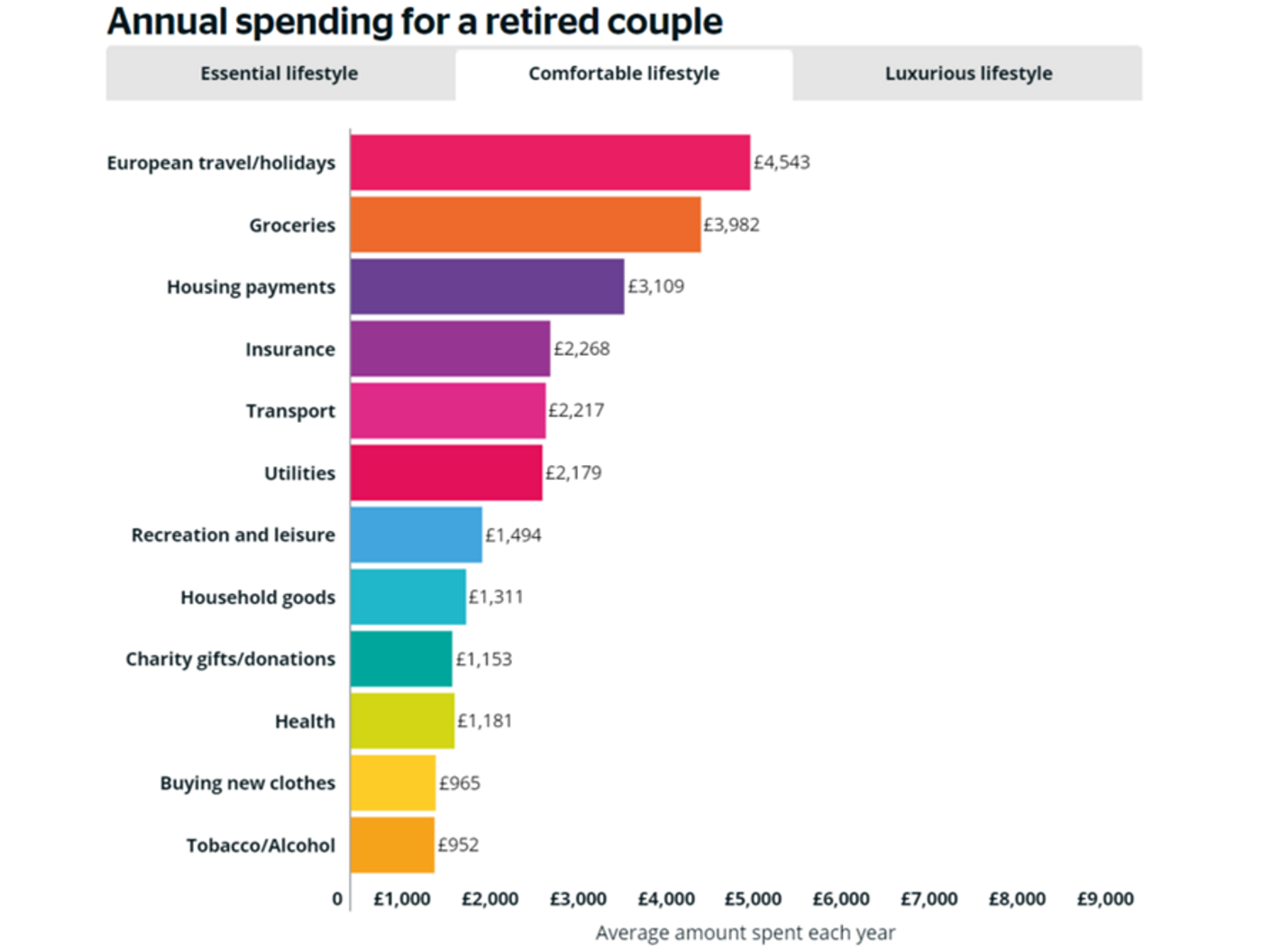

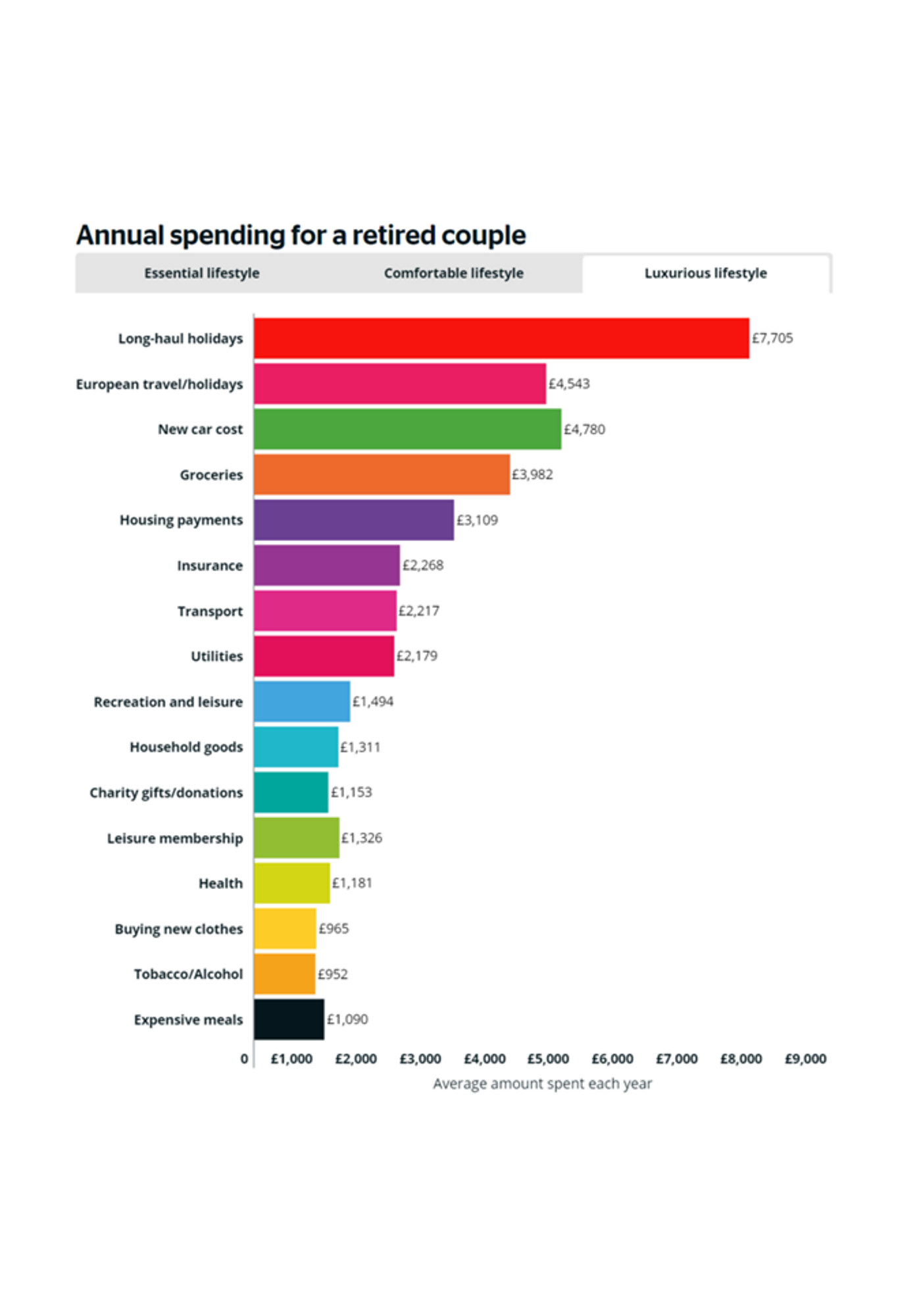

It is highly likely that by the age of retirement your financial commitments will have changed in some way, you may have paid off your mortgage on your home, or no longer need to provide financial support for your children. You may also wish to travel more or take up additional hobbies in your spare time, or feel you wish to prioritise and spend more on your health – all of which would determine how much income you would require from your pension pot. The important question to bear in mind, is the type of lifestyle you plan to have during retirement.

Below are three illustrative graphs detailing the average amount spent in a year by retired couples ranging from an essential lifestyle to a luxurious retirement.

*source which.co.uk based on a survey conducted on 6,300 retired or semi-retired couples in April 2020.

Essential lifestyle average annual total spend: £17,212

Comfortable lifestyle average annual total spend: £25,354

Luxurious lifestyle average annual total spend: £40,255

*Note examples are for illustration only. Each individual circumstances and outgoings will differ.

As well as the details provided above, there are also several other benefits or freedoms that pensions can provide that are accessible pre-retirement age. Click to register and view our boxset on Pension Freedoms, and if you wish to speak to an Advisor about any aspects of pensions and planning for retirement, please do not hesitate to contact BRI on 01676 523 550 or make an enquiry here.